Nowadays, close to half the consumers affirm turning toward the plant-based products market as an alternative to milk (1). Between the environmental impact, nutritional benefits and health issues, let’s see why this plant-based trend is widely popular.

Seeking ecological products and alternatives to animal proteins

In OECD countries, observations made on food safety are alarming (2). The consumption of meat and excessively fatty, salty and/or sweet processed foods and sodas, lead to a noticeable increase in chronic diseases like diabetes, obseity, cardio vascular diseases and certains cancers.

The main market driver is therefore consumers seeking natural products meeting several objectives:

- a healthy and functional diet,

- a reduced intake of sugar,

- vitamins and natural minerals,

- actives and especially an alternative to animal proteins.

During the COVID-19 pandemic in Western countries, the demand for plant-based foods developed and the categories of milk substitutes exploded (3).

According to a Euromonitor report (July 2021) concerning plant-based diets and protein alternatives, 16 % of the world propulation affirms following a plant-based diet and 15 % of them wish to limit dairy products (4).

Concerns about the climate foster food choices on an international level and are presented in the second report (5) (March 2022): among 60% of world consumers are concerned about climate change, 77% try to have a positive impact on the environment, while 27% try to decrease their consumption of meat.

The question about feeding ourselves without impacting the animal world while preserving crops needing less water is one of many essential questions raised by consumers.

Plant-based products also respond to environmental concerns: 2/3 of consumers in the world are concerned by the environment and try to adjust their diet accordingly and 68 % buy plant origin beverages for sustainable development and health reasons (6). Even though 77 % of consumers consider taste as the most important criteria, sustainable development is becoming increasing relevant when making choices.

In this manner, plants represent a constantly innovating dynamic segment where organic and natural product references are gaining pertinence (7). Products with "plant-based" claims are seen as more inclusive and attractive for consumers. The association of claims or a plant-based brand strengthens confidence and adds to transparency due to the product being 100% plant-based.

There are additional and miscellaneous factors which push consumers to opt for these plant alternatives including dairy product intolerances concerning 75% or the worldwide adult population. This is based on reduction in lactose digestion capacity due to age, along with newborn and children’s cow milk allergies. In fact, plant milk is lactose and caseine-free and contains no antibiotics or chloresterol sometimes found in industrial milk, while providing fibers, minerals and vitamins for our bodies.

Health and nutrition benefits

In addition to the multitude of plant-based or plant-derived ingredients, the concepts of superfoods and gustatory pleasure are also very popular. Flowers and plants are very much in vogue and meet a need for benefits and naturalness.

Detoxifying against outside aggressions, de-stressing to fight against anxiety, with sedative virtues for a restful sleep, natural ingredients have an array of health assets that convince consumers in perpetual search of well-being to turn to plants. Through this offer, the brands ensure clarity, simplicity and naturalness.

In 2020, according to the "Groupe d'Etude et de Promotion des Protéines Végétales" (GEPV) and Protéines France, beverages and desserts are respectively in second and third position on the list of plant-based protein products most consumed by French consumers (8). In 2021, we note that the market for plant-based products is still dominated by milk substitutes and that in Europe it represents 7.98 million euros.

Plant proteins are now perceived as being of better quality than animal proteins, both for health (53%) reasons and from an environmental stand point (60%), according to the 2020 consumer barometer of GEPV and Protéines France. Plant-based products are playing the nutritional quality card with a sought-after protein gain and are the main driver of innovation in this sector.

Nutritional claims such as "high fiber" or "high protein" are often combined with quality criteria such as "plant-based vitamins and minerals" or "certified organic".

Consumers are looking for products that can accompany them in a healthy lifestyle and plant-based alternatives are suitable product categories with this aim in mind. These products have experienced the strongest growth over the last five years. On the other hand, we notice that on the alternatives to dairy products with an "Energy" positioning, naturalness is the claim that stands out in first position.

Launches and growth of health-oriented dairy products in the world between 2017 and 2021, 59% are based on energy aspects, 51% for immunity and 18% for joints (9).

Innovate in the plant-based product universe: a challenge to be met

For some consumers, plant-based products differ from traditional milk in terms of texture and taste. Producing plant-based alternatives is a real challenge given the very different functional properties of plant proteins (elasticity, solubility, etc.), which result in a product with a specific texture.

Creating a plant-based cuisine while replacing milk means innovating by developing aromatic solutions to improve the taste of vegetarian products and designing products with new textures and appearances that correspond to the economic, ecological and food issues of the present and future world.

The market has thus opened up to numerous opportunities made possible by plant-based alternatives, ranging from yoghurt to creams to ice cream. There is now a wide choice of desserts and cheeses for all tastes and budgets, with each major supermarket chain having developed a range devoted to plant-based products.

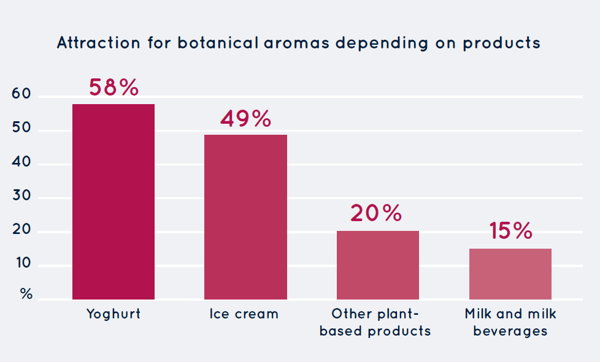

Consumers like botanical flavours in dairy products, especially in yogurt and ice cream. The appeal for these flavours is 58% in yoghurt, 49% in ice cream, 20% in other plant-based products and 15% in milk and dairy drinks (10).

Examples include rice, quinoa, chestnut, almond, hazelnut, oat, coconut and hemp-based plant options (plain or caramel, chocolate, vanilla, etc. flavoured). Increasingly popular, pea-based products have a high protein content. As such, they are a choice for vegans or people who want an alternative source of protein.

Cheese specialties with yoghurts form a very dynamic sector and milk has been replaced by other protein sources: tofu, kefir, soy, cashew nuts. New plant-based cheeses such as "parmesan", "mozzarella", "cheddar" or "grated pizza cheese" already exist in vegan variations. There are also products similar to goat cheese, made from cashew nuts or almonds which are herb, cumin or spirulina flavoured.

The role of plant-based ingredients and process monitoring related to processing techniques is a real challenge in the field of dietary supplements, beverages, snacks and new plant-based applications. The opportunities to benefit from the growth of this sector are numerous and closely linked to consumer concerns regarding their search for alternative protein sources.

In the coming years it is therefore expected that the plant-based food space will grow considerably and that many high potential natural products will be launched.

Please feel free to contact us.

To see our entire product range, check out our online catalogue available 24 HOURS A DAY 7 DAYS A WEEK.

Sources :

(1) https://fmcggurus.com/blog/fmcg-gurus-the-growing-plant-based-market-dairy-alternatives/

(2) http://www.fao.org/statistics/standards/fr/

(3) https://www.euromonitor.com/the-rise-of-vegan-and-vegetarian-food/report?recid=2142062445065&id=701927

(4) https://www.euromonitor.com/plant-based-eating-and-alternative-proteins/report

(5) https://www.euromonitor.com/driving-forces-behind-plant-based-diets-climate-concern-and-meat-reduction/report?recid=2142060734665&id=623988

(6) FMCG Gurus, Q4 2020

(9) Source : Dairy Trends in 2021, Mintel GNPD

(10) FMCG Gurus - Flavour, colour and texture, 2020

Pierre Aveline

Marketing Director

Leave a comment